Understanding Cap Rates and How They Affect Investments

When it comes to investing in the tech sector, it’s essential to understand key financial metrics like cap rates. Cap rates, short for capitalization rates, are a crucial tool used by investors to evaluate the potential return on investment for a property or asset. In this article, we’ll break down what cap rates are, how they are calculated, and most importantly, how they can impact your tech investments.

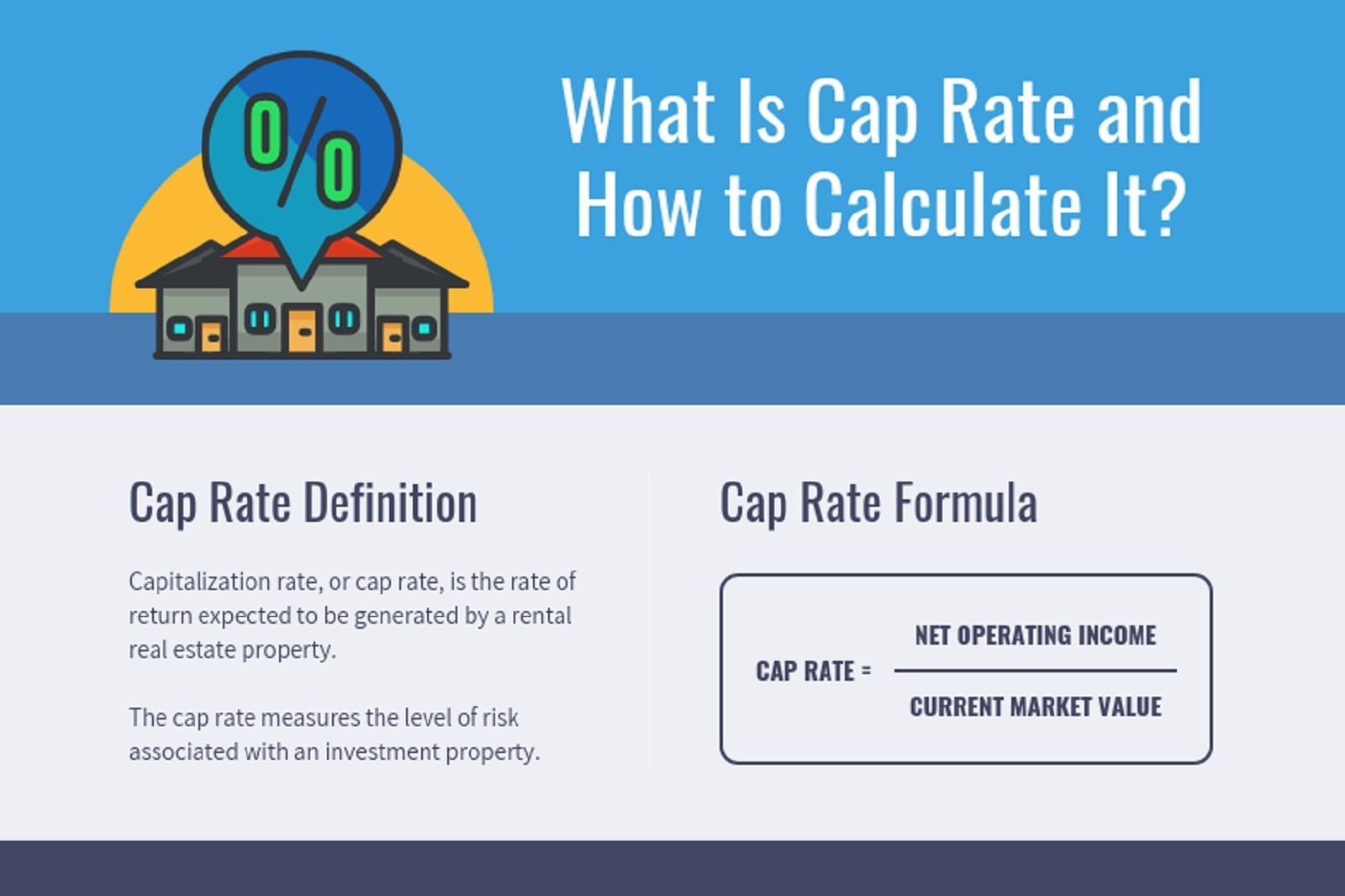

What Are Cap Rates?

Cap rates are a measure of the rate of return on an investment property based on its net operating income (NOI) and current market value. Essentially, cap rates help investors determine the risk and potential reward of a particular investment by comparing the expected income to the price of the asset. The higher the cap rate, the higher the potential return on investment.

How Are Cap Rates Calculated?

Cap rates are calculated by dividing the property’s NOI by its current market value. The formula for calculating cap rates is as follows:

Cap Rate = Net Operating Income ÷ Current Market Value

For example, if a tech company’s office building generates $500,000 in annual net operating income and is valued at $5 million, the cap rate would be calculated as follows:

Cap Rate = $500,000 ÷ $5,000,000 = 0.10 or 10%

How Do Cap Rates Affect Tech Investments?

Cap rates play a crucial role in determining the potential return on investment for tech assets such as office buildings, data centers, and research facilities. Higher cap rates indicate higher potential returns, but they also come with higher risks. Tech investments with higher cap rates are often riskier and may require more due diligence to ensure a positive return.

Conversely, lower cap rates indicate lower potential returns, but they also come with lower risks. Tech investments with lower cap rates are generally considered safer investments with more stable income streams. These types of investments are often favored by investors looking for long-term growth and stability.

Factors to Consider When Evaluating Cap Rates

When evaluating cap rates for tech investments, there are several factors to consider:

Market Conditions: Cap rates can vary depending on market conditions, such as supply and demand, economic trends, and interest rates.

Property Type: Different types of tech assets may have different cap rates based on factors like location, age, and tenant occupancy.

Asset Management: The effective management of tech assets can impact NOI and ultimately cap rates.

Risk Tolerance: Investors with a higher risk tolerance may be more willing to invest in tech assets with higher cap rates.

Conclusion

Cap rates are a valuable tool for tech investors looking to evaluate the potential return on investment for various assets. By understanding how cap rates are calculated and how they can impact tech investments, investors can make more informed decisions about where to allocate their capital. As with any investment, it’s essential to conduct thorough due diligence and consider all factors before making a decision. With a solid understanding of cap rates, investors can maximize their returns and minimize their risks in the tech sector.